Could We stop the sent gmail? Solution is here

My dear friends.....

Gmail is one of the most useful e-mailer to all and in fact it is having so many useful tools also in it. Still we are not using the full privileges of these tools since we are not much aware of those tools usage. For example could we stop the gmail from delivering to the recipient? Answer is yes.

How to revert back the gmail after clicked the send button?

1. Please login to your gmail account

2. Click the settings option, located on the right top corner

3. Click labs in Settings menu

4. scroll down in the labs menu

5. There is a provision as Undo Send( If you could not found this undo send option then use ctrl+f to find the undo send option)

6. Now select enable in Undo Send option

7. After that at last click save changes. That’s all

Now whenever you click the send option after composed a mail there is one pop up will be appeared "your message has been send. Undo. View message"

By clicking undo in few seconds we could prevent the mail to deliver to the recipient. As a result we could prevent the wrongly composed Gmails and partially composed Gmails.

My dear friends.....

Gmail is one of the most useful e-mailer to all and in fact it is having so many useful tools also in it. Still we are not using the full privileges of these tools since we are not much aware of those tools usage. For example could we stop the gmail from delivering to the recipient? Answer is yes.

How to revert back the gmail after clicked the send button?

1. Please login to your gmail account

2. Click the settings option, located on the right top corner

3. Click labs in Settings menu

4. scroll down in the labs menu

5. There is a provision as Undo Send( If you could not found this undo send option then use ctrl+f to find the undo send option)

6. Now select enable in Undo Send option

7. After that at last click save changes. That’s all

Now whenever you click the send option after composed a mail there is one pop up will be appeared "your message has been send. Undo. View message"

By clicking undo in few seconds we could prevent the mail to deliver to the recipient. As a result we could prevent the wrongly composed Gmails and partially composed Gmails.

CONSIDERATION ON COMPASSIONATE ENGAGEMENT OF GDS POSTS

Department of Posts issued Orders for Consideration of Compassionate Engagement on GDS posts to Dependants of Gramin Dak Sevaks Discharged on Medical Grounds based on proof of invalidation prior to 14.12.2010 (The period From 01.01.1996 to 13.12.2010 by the prescribed appointing authority based on medical invalidation by a medical board of a Government Hospital and the disability would cover only the disabilities mentioned and defined in Section 2 of the PWD Act, 1995." While considering the cases under this provision, Head of the Circle would personally ensure that only the cases fulfilling the requisite conditions are considered for compassionate engagement)

Government of India

Ministry of Communication & IT

Department of Posts

(GDS Section)

Dak Bhawan, Sandad Marg

New Delhi – 110001

No. 19-19/2009-GDS Dated: 21 Feb 2012

Chef Postmaster General

Postmaster General

CONSIDERATATION OF COMPASSIONATE ENGAGEMENT ON GDS POSTS TO DEPANDANTS OF GRAMIN DAK SEVAKS DISCHARGED ON MEDICAL GROUNDS BASED ON PROOF OF INVALIDATION PRIOR TO 14.12.2010

A reference is invited to Para 7(d) of this Directorate letter No. 17-17/2010-GDS dated 14.12.2010 wherein it was provided that "this percentage of 10% shall only apply to cover cases of wards of deceased GDS and not to GDS acquiring disability during service defined in the Persons with Disabilities Act, 1995. Section 47 of the Persons with Disabilities Act, 1995 provides that no establishment shall dispense with or reduce in rank an employee who acquires a disability during his service as also no promotion shall be denied to a person merely on the ground of his disability. In case of a GDS acquiring a disability during his service and is considered to be unsuitable for the GDS post he was holding, could be shifted to some other post with the same TRCA." The ceiling of 10% was further removed with revised provisions under this Directorate letter No. even dated 01.08.2011.

2. The issue of allowing compassionate engagements to one of the dependant of the GDS discharged on invalidation on medical grounds supported by the invalidation proof has been considered in this Directorate and it has now been decided to allow considering compassionate engagement to one of the words of invalidated GDS discharged before the date of issue of this Directorate letter No. 17-17/2010-GDS dated 14.12.2010 on consideration of the indigent condition of the family taking recourse to the application of the same provisions of compassionate engagement and process as were in force at the time of discharge of the GDS on invalidation, without a further reference to this Directorate.

3. It is, however, clarified once again that the provision contained in Para 7 (d) of this Directorate letter No. 17-17/2010-GDS dated 14.12.2010 as amended may be observed scrupulously and no GDS is allowed to be discharged on invalidation observing the provisions of Section 47 of the Persons with Disabilities Act, 1995. In case a GDS acquires a disability during his service and is considered to be unsuitable for the GDS post he was holding, he/she may be shifted to some other post with the same TRCA. If at all some genuine difficulty arises about the nature of work to be extracted from him and the concerned HOC is personally convinced of the grounds in individual cases, the Circles may take up the issue of appropriate cases with the Training Division of this Directorate.

4. The instructions contained in Para 7(d) of this Directorate letter No. 17-17/2010-GDS dated 14.12.2010 & the present instructions would cover the cases of the GDS where a GDS was permitted to be discharged during the period from 01.01.1996 to 13.12.2010 by the prescribed appointing authority based on medical invalidation by a medical board of a Government Hospital and the disability would cover only the disabilities mentioned and defined in Section 2 of the PWD Act, 1995." While considering the cases under this provision, Head of the Circle would personally ensure that only the cases fulfilling the requisite conditions are considered for compassionate engagement.

5. The above provisions may be brought to the notice of all concerned for strict compliance. This issue with the approval of Secretary(Posts).

Sd/-

(Surender Kumar)

Assistant Director General (GDS)

RTI Queries Don't Affect Govt. Work

RTI Queries Don't Affect Govt. Work

The time spent by government officials replying to RTI is so little that it cannot be a pretext for them to shirk that task

|

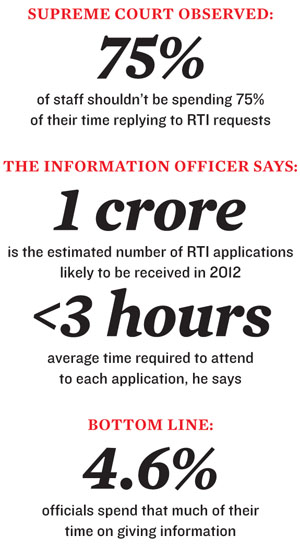

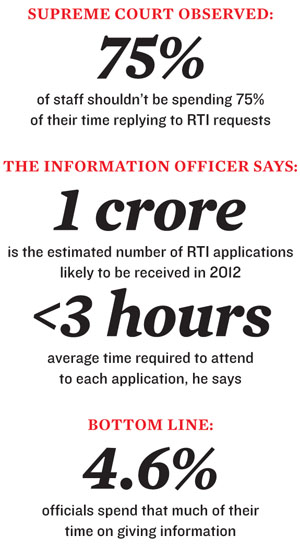

n August 2011, the Supreme Court made an observation which had some unintended consequences on the Right to Information (RTI) process. The judgement by Justice R.V. Raveendran is turning out to be a seemingly legitimate excuse for government officials to restrict information.

Aditya Bandopadhyay went to court when the Central Board of Secondary Education declined to provide his examination answer sheets under the RTI Act. While the court allowed access to answer sheets, it also observed that the cherished right to information should not affect administrative efficiency.

In his judgement, Justice R.V. Raveendran said: “The nation does not want a scenario where 75 percent of the staff of public authorities spends 75 percent of their time in collecting and furnishing information to applicants instead of discharging their regular duties. The threat of penalties under the RTI Act and the pressure of the authorities under the RTI Act should not lead to employees of public authorities prioritising information furnishing at the cost of their normal and regular duties.” Government officials are now using this excuse with increasing frequency saying that even the court agrees. Central Information Commissioner Shailesh Gandhi says 75 percent government staff spending 75 percent of their time on giving information would mean 56 percent (0.75 X 0.75) of their total time spent only on replying to RTI queries.

Gandhi says that at the most optimistic estimate not more than one crore RTI applications are likely to be received by all public authorities across the country in 2012. The average time to attend to each would be less than three hours. That means no more than three crore hours spent by all officials. Aditya Bandopadhyay went to court when the Central Board of Secondary Education declined to provide his examination answer sheets under the RTI Act. While the court allowed access to answer sheets, it also observed that the cherished right to information should not affect administrative efficiency.

In his judgement, Justice R.V. Raveendran said: “The nation does not want a scenario where 75 percent of the staff of public authorities spends 75 percent of their time in collecting and furnishing information to applicants instead of discharging their regular duties. The threat of penalties under the RTI Act and the pressure of the authorities under the RTI Act should not lead to employees of public authorities prioritising information furnishing at the cost of their normal and regular duties.” Government officials are now using this excuse with increasing frequency saying that even the court agrees. Central Information Commissioner Shailesh Gandhi says 75 percent government staff spending 75 percent of their time on giving information would mean 56 percent (0.75 X 0.75) of their total time spent only on replying to RTI queries.

Assuming that an average government employee works for just six hours a day for 200 days a year, it would mean he would work for a total of 1,200 hours in a year. That means 25,000 (3 crore divided by 1,200) employees would be required full time. The Centre and all state governments have about 1.2 crore employees. So, the total time spent by government employees on replying to RTI queries would be 0.208 percent (25,000 divided by 12,000,000).

In other words, no more than 4.6 percent officials are spending 4.6 percent of their time on giving information. This is based on conservative assumptions. Surely, government officials work for more than six hours a day! Doesn’t look like they have much space to hide.

The Form 16 treated as Income Tax Return for salaried individuals with a total taxable income of up to Rs 5 lakh

Varanasi, Feb16, 2012: Salaried individuals with a total taxable income of up to Rs 5 lakh do not have to file income tax returns. However, in case tax payers want to seek an income tax refund , they will have to file their returns.

In the above case, a salary people has income from other sources like dividend, interest etc.not exceeding Rs.10 thousand and does not want to file returns, he has to disclose such income to his DDO.

The Form 16 is issued by DDO to salaried employees may be treated as Income Tax Return.

According to the notification, individuals having total income up to Rs 5 lakh for financial year, after allowable deductions, consisting of salary from a single employer and interest income from deposits in a saving bank account of up to Rs 10,000 are not required to file their income tax return.

Such individuals must report their Permanent Account Number (PAN) and the entire income from bank interest to their DDO, pay the entire tax by way of deduction of tax at source, and obtain a certificate of tax deduction in Form No. 16

However, persons receiving salary from more than one employer, having income from sources other than salary and interest income from a savings bank account, or having refund claims shall not be covered under the scheme.

Courtesy : http://tkbsen.com/

Varanasi, Feb16, 2012: Salaried individuals with a total taxable income of up to Rs 5 lakh do not have to file income tax returns. However, in case tax payers want to seek an income tax refund , they will have to file their returns.

In the above case, a salary people has income from other sources like dividend, interest etc.not exceeding Rs.10 thousand and does not want to file returns, he has to disclose such income to his DDO.

The Form 16 is issued by DDO to salaried employees may be treated as Income Tax Return.

According to the notification, individuals having total income up to Rs 5 lakh for financial year, after allowable deductions, consisting of salary from a single employer and interest income from deposits in a saving bank account of up to Rs 10,000 are not required to file their income tax return.

Such individuals must report their Permanent Account Number (PAN) and the entire income from bank interest to their DDO, pay the entire tax by way of deduction of tax at source, and obtain a certificate of tax deduction in Form No. 16

However, persons receiving salary from more than one employer, having income from sources other than salary and interest income from a savings bank account, or having refund claims shall not be covered under the scheme.

Courtesy : http://tkbsen.com/

NEW RULINGS TO Seize Property of CORRUPT OFFICIALS

Corrupt public officials beware!

The Centre has issued new guidelines to seize properties or money of government officials involved in corrupt practices even after their retirement.

According to new norms made in consultation with the Ministry of Law and Justice, a competent authority in concerned department can give authorisation to the Centre to attach properties or wealth of the accused employee acquired through corrupt practises after his retirement.

The guidelines assume significance as most of the departments and investigating agencies like CBI have expressed difficulty in acting against corrupt public servants who have retired pending charge sheet or charges under the Prevention of Corruption Act.

“Departments have written to us seeking clarification while attaching properties of a corrupt officials. More difficulties were being faced in case of retired government officials. Hence, we decided to get the issue resolved,” a senior official of the Department of Personnel and Training (DoPT) said.

He said a set of guidelines have been issued to all the departments under the Government, including the CBI.

The Section 3 of the Criminal Law (Amendment) Ordinance, 1944, authorises the Government to attach properties of a person said to have procured through corrupt means.

However, the clause lacks clarification for seizure of properties in case of pending charge sheet, sanction of prosecution or in case of retirement of a corrupt person.

“In the case of retired public servants, even though the charge sheets are filed without obtaining sanction for prosecution under Section 19 (1) of the PC Act, 1988, the Government or authority which would have been competent to remove the public servant from his office at the time when the offence was alleged to have been committed should be competent to give authorisation...for attachment of money or procured by means of scheduled offences,” the official said.

He said in cases where the competent authority cannot be equated with the central government, the administrative ministries of the concerned competent authorities can file an application seeking attachment of money or properties of a corrupt public servant.

The Section 19 (1) of the PC Act says that “no court shall take cognizance of an offence punishable under Sections 7, 10, 11, 13 and 15 alleged to have been committed by a public servant, except with the previous sanction”.

The sections deals with acts of corruption by a public servants.

Clarification Regarding regulation of payment of Employer's share of contribution to the Contributory Provident Fund

No 6/8/2009-Estt.(Pay II)

Government of India

Ministry of Personnel, Public Grievances & Pensions

Department of Personnel & Training

Government of India

Ministry of Personnel, Public Grievances & Pensions

Department of Personnel & Training

OFFICE MEMORANDUM

Subject:- Clarification regarding regulation of payment of employer’s share of contribution to the Contributory Provident Fund during the period of reverse deputation.

The undersigned is directed to refer to this Department’s 0.M,No. 6/8/2009.Estt.(Pay II) dated 17th June, 2010 vide which instructions were issued for regulating the terms and conditions of pay, Deputation (duty) allowance etc. on transfer on deputation/foreign service of Central Government employees to ex-cadre posts under the Central Government/State Governments/Public Sector Undertakings/Autonomous

Bodies, Universities/UT Administration, Local Bodies etc. and vice-versa,

Bodies, Universities/UT Administration, Local Bodies etc. and vice-versa,

2. As per para 7.7 (ii) of the above cited 0M., in the case of deputation on foreign service terms to PSUs etc., leave salary contribution and pension contribution/CPF contribution are required to be paid either by the employee himself or by the borrowing organisation to the Central Govt.

3. The issue of payment of employer’s share of Contribution to the Contributory Provident Fund in case of reverse deputation has been considered in this Department. It is clarified that in case of reverse deputation the employer’s share of Contributory Provident Fund for the period on deputation to the Central Government will be borne either by the employee himself or the borrowing organization i.e Central Government depending on the terms of deputation. A clear mention of the stipulation on whether the Central Government or the employee would bear the liability may be made in the terms of deputation.

(Mukesh Chaturvedi)

Deputy Secretary (Pay)

Deputy Secretary (Pay)

SOURCE :PERSMIN

KEY REFERENCES OF 44TH INDIAN LABOUR CONFERENCE

Minimum Wages Act Coverage for all Employments

Raising The Wage Ceiling in the Employees Provident Fund, Enhancement of Pension Under Employees Pension Scheme 95, Portability of PF Account, Reduction in the Requirement of Minimum Continuous Service, Etc.

Stress on Matching the Large Scale Skilling Targets with Creating Similar Number of Openings in the Area of Employment

Maternity Leave Under the Maternity Benefit Act be Increased from the Present Level of 12 Weeks to 24 Weeks

Union Labour & Employment Minister Shri Mallikarjun Kharge today detailed about the recommendations made during the 44th Indian Labour Conference concluded atVigyan Bhavan, New Delhi

The Conference was inaugurated by Hon’ble Prime Minister of India. The Conference was attended by Labour Ministers from 14 State Governments. All the major 12 Central Trade Union Organisations and 6 major employers’ organisation participated in the Conference. Besides, senior officials from 23 Central Ministries and all State Governments/UTs attended the Conference. The International Labour Organisation Experts based at Delhi

Shri Kharge referred the Prime Minister inaugural address in which he emphasized the great importance that the UPA Government attaches to the promotion of healthy industrial relations and well being of our workforce.

Shri Kharge said our huge unorganized sector poses great challenges in ensuring quality employment and extension social security coverage. Minimum Wages are an important means of protecting the interest of the workers were not in the formal sector. Our flagship health insurance scheme “Rashtriya Swasthya Bima Yojana” has covered 2.5 croreBelow Poverty Line families and this Scheme is being extended to cover other category of workers.

According to the minister the Conference Committee on “Minimum Wages” recommended that the Minimum Wages Act should cover all employments and thus facilitateIndia

Also the Conference Committee on “Social Security” had very focused discussion and came out with specific recommendations in the areas of raising the wage ceiling in the Employees Provident Fund, enhancement of pension under Employees Pension Scheme 95, portability of PF Account, reduction in the requirement of minimum continuous service, etc. The Committee addressed the gender issues by recommending enhancement of maternity leave. The MSME Sector and unorganized sector workers received special attention of the committee members. Our Ministry’s RSBY Scheme has achieved a lot of success and various recommendations were received for bringing other category of workers under its coverage and adding other type of benefits in addition to the existing ones.

Moreover, the Conference Committee on “Employability and Employment” recommendations laid stress on matching the large scale skilling targets with creating similar number of openings in the area of employment. Labour intensive industries need to be promoted and protected. The forthcoming National Employment Policy should be able to provide enabling framework for facilitating employment generation and decent work in the unorganized sector. The Labour Market Information System should give real time information about skill requirements and skill availability. Other innovative suggestion were bringing the traditional skills under the certification system and involving MSMEs in skill development. The road map for skilling 500 million persons by 2022 should be finalized in consultation with the tripartite partners.

Shri Kharge said, this Session of the Conference carried forward the rich tradition of healthy social dialogue, spirit of accommodation and keeping interest of our workforce as the top most priority. The tripartite partners have shown full concern to the important responsibility we have towards our country’s growth and safeguarding the basic interest of our workers. We will be very closely following up with the implementation of policy solutions arrived at the Conference and the same will be reviewed in the meeting of the next Standing Labour Committee.

The Recommendations of the Conference Committee on Employability and Employment are:

1. Employment generation and Employability should be top agenda of the Govt.

2. Though lot of focus is being laid on training of 500 million persons by 2022, there is a need to take appropriate measures for creation of employment opportunities to offer the matching employment.

3. There is an urgent need to declare the National Employment Policy in order to provide enabling framework for facilitating employment generation and decent working conditions for all.

4. Investment in labour intensive industries should be promoted and incentivised.

5. Labour Market Information System should be established to get skill requirement from the industry and available skills from the institutes. In this regard, employment exchanges may be modernized for providing virtual job market on real time basis.

6. Skill mapping should be done at the local level and inventory of skill assets should be created.

7. ITIs should also focus on sectors beyond manufacturing and should concentrate on service sector. There is urgent need for quality assurance measures in training of ITIs and instructors.

8. Emphasis should be laid on development of infrastructure including storage, processing and marketing in rural areas and agro-based industries.

9. ITIs should focus more on popular trades keeping in view the requirement of the local industries.

10. Institutional arrangements for providing training in traditional skills should be encouraged and may brought under certification system.

11. Public awareness programme should be taken up, particularly in rural areas regarding the importance of skill development and certification of traditional skills.

12. There should be functional and spatial integration of State and Central infrastructure and other available resources for optimal utilization of resources.

13. MSMEs should be encouraged and supported to participate in the skill development efforts.

14. Stipend of apprentices under the Apprentices Act should be enhanced.

15. Existing and new Centres of Excellence/Clusters in traditional crafts should be strengthened and provided support in terms of marketing, credit, new technology, etc. to promote self-employment.

16. Barriers should be removed from skilling and certification of illiterate and uneducated workers.

17. Entrepreneurship and self-employment should be encouraged by providing necessary support.

18. Existing employment in the unorganized sector should be safeguarded by assuring access to natural resources for those sectors dependent on them. In order to increase their productivity, appropriate advanced tools and technology for traditional producers should be developed.

19. Skill development should be promoted among the women and differently-abled persons. To increase participation of women in skill development, special measures should be taken.

20. Centres of Excellence should be established at the national and State levels which will produce world-class technicians.

21. National level consultation with all the stakeholders should be held immediately to finalize the road-map for preparing skill development plan leading to skilled force of 500 million persons by 2022.

22. Comprehensive steps should be taken to create environment for employment generation and protection.

23. Trainers should be trained in large numbers to meet growing requirement.

During the Conference a Committee was constituted to discuss Agenda Item No.(i) concerning Minimum Wages and related issues. These issues, inter alia, include norms for fixation/revision of minimum rates of wages, Variable Dearness Allowance(VDA), National Floor Level Minimum Wages etc. On the basis of detailed discussion, the following points emerged.

1. There was consensus that the Government may fix minimum wages as per the norms/ criteria recommended by the 15th ILC (1957) and the directions of the Hon’bleSupreme Court (Repttakos Co. Vs Workers’ Union) 1992. The Government may take necessary steps accordingly.

2. There was a broad consensus that the Minimum Wages Act should cover all employments and the existing restriction for its applicability on the scheduled employments only should be deleted. This will also help India

3. It was broadly agreed that there should be national minimum wages applicable to all employments throughout the country.

4.There was broad agreement on the amendment proposals as listed out in Para 5(iv, v & x).

5. In respect of 5 (iv), it was pointed out that the payment to the apprentices should be treated differently from the other categories.

6.The Committee noted that at present there are 12 States/UTs who have not adopted VDA. There was a broad consensus that all States/Uts should adopt VDA.

7. It was also recommended that the payment of minimum wages should be done through Banks/Post Offices etc.

8. As regards 5(vi), it was felt that the enforcing agencies should not be given the power of adjudication and, therefore, this proposal should be re-examined.

9. The proposal of paying different minimum wages in respect of same employment either in the Centre or in the State should be done away with.

A Conference Committee was also constituted to discuss the agenda item No. (iii) i.e.“Social Security”. On the basis of detailed discussions, the following points emerged :-

(i) There was a broad-based consensus that the wage ceiling for the application of EPF Act be increased from the present level of Rs.6,500/- to Rs.10,000/- or Rs.15,000/- as already applicable for the ESI Corporation. Similarly, the ceiling for workers covered under EPF Act be reduced from 20 to 10. However, Laghu Udyog Bharati was not agreeable to this reduction in ceiling of number of workers.

(ii) Minimum pension under the EPS 95 be increased to some floor level, which should not be less than Rs.1,000/-, since a large number of workers receive pension which is less than that provided by the State Governments for elderly people which is normally in the range of Rs.400/- to Rs.1000/-.

(iii) The PF Accounts be computerized urgently so that the workers are able to avail the facility of PF transfer and settlement immediately. Smart Cards like RSBY be issued to PF account holders.

(iv) Minimum ceiling of 5 years of continuous service be reduced in case of gratuity and gratuity be made transferable in case of change of job by the employee.

(v) The maternity leave under the Maternity Benefit Act be increased from the present level of 12 weeks to 24 weeks. This increased maternity benefits be made available only upto two children, while the lower limit becontinued for more than two children.

(vi) Accountability on the part of organizations implementing the social security schemes be fixed in order to ensure that the beneficiaries receive the deliverables in time. Citizen Charters for these organizations be finalized early.

*******

Subscribe to:

Posts (Atom)