గుంటూరు డివిజన్ ప్రియతమ నాయకులు, ఆల్ ఇండియా పోస్టల్ ఉద్యోగుల సంఘం Group 'c' అఖిలభారత అధ్యక్షులు గా పనిచేసిన శ్రీ శివ నారాయణ గారు కొద్ది సమయం క్రితం తన స్వగృహం వద్ద పరమపదించారు. వారు గత కొన్ని రోజులుగా మూత్రపిండాల వ్యాధితో బాధపడుతున్నారు మూడు రోజుల క్రితం చెన్నై నుంచి తిరిగి వచ్చి ఈ రోజు ఉదయం పరమపదించారు.

-----------------------------------------------------------------------------------------

NFPE CHQ:

-----------------------------------------------------------------------------------------

Com.R.ShivNarayana,Ex, President P3CHQ Expired today on 26thJuly 2020 .He was suffering from abdominal Cancer.

Com.ShivNarayana was a very good Organizer and Avery disciplined Comrade,

He was inducted in CHQ Team in 1997 AIC Vrindaban,Mathura along with me and Com.M.Krishnan, R.N.Chaudhary, B.G.Tamhankar as Vice President and continued till his retirement upto 2014 in various capacities as ASG,Dy.G/S and President.

He has also officiated as General Secretary for some time.

He has also officiated as General Secretary for some time.

He remained in CHQ on Foreign Service for long time With Com.KVS and Com.Krishnan.

He contributed a lot in running CHQ.

We on behalf of NFPE and P3 CHQ Convey our heartfelt condolences to bereaved family members and Comrades of Andhra and Guntur.

We pray eternal peace for departed soul.

WE DIP OUR BANNER IN RESPECT OF HIM.

COM.SHIVNARAYANA AMAR RAHE.

R.N.Parashar

SG.NFPE & G/S P-3CHQ

------------------------------------------------------------------------------------

SA POST:

------------------------------------------------------------------------------------

It is our misfortune that Comrade Ravi Sivannarayana former Deputy GS and CHQ President of AIPEU Group C breathed his last today 26.07.2020 at Guntur (AP). He was a staunch trade union leader and led many movement for the interests of Postal Workers including the GDS. He invariably attends all Circle Conferences of Tamilnadu Circle also including the latest conference recently held at Coimbatore.

He was a close friend and comrade to many leaders like C.C.Pillai, K.Ragavendran, M.Krishnan (all former SG NFPE) and comrade K.V.Sridharan (Former GS P3). He was the officiating GS also and conducted the AIC at Kerala and handed over the responsibility of GS to Comrade M.Krishnan. A comrade with smile always and used to help any worker in trouble.

Comrade Sivannarayana was reportedly under cancer treatment in Chennai for the past three or four months. May be due to lockdown he chose not to inform us. Four days back he was sent to his home town Guntur because of advance stage of brain cancer , where he was admitted again. Today morning he lost his consciousness and at about 4.00 P.M declared as dead by hospital authorities in Guntur.

We dip our banner in honour and memory of comrade Ravi Sivannaraya!

------------------------------------------------------------------------------------

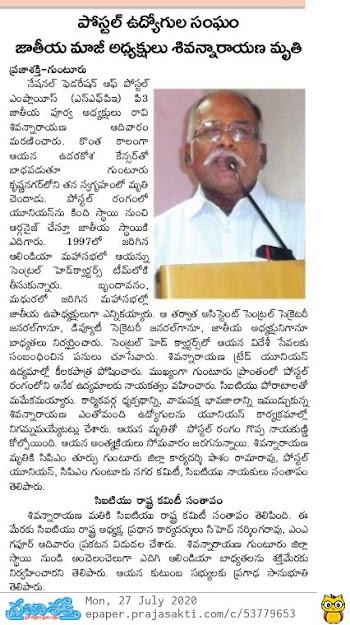

ప్రజా శక్తి:

------------------------------------------------------------------------------------

------------------------------------------------------------------------------------

GUNTUR HO:

------------------------------------------------------------------------------------

------------------------------------------------------------------------------------

GUNTUR COLLECTORATE:

------------------------------------------------------------------------------------

------------------------------------------------------------------------------------

KOTHAPET SO:

------------------------------------------------------------------------------------

------------------------------------------------------------------------------------

PATTABHIPURAM SO:

------------------------------------------------------------------------------------